How a 113-year-old water bottle became a pop culture status symbol

Screengrab: Official Stanley website

ISLAMABAD: Tumblers have existed for decades, but Stanley’s Quencher turned a simple water bottle into a viral phenomenon that still remains relevant today. The company single-handedly redefined the meaning of quiet luxury consumerism, driving the brand’s sales from $73 million in 2019 to $750 million by 2023, a figure widely quoted by international media.

Once primarily marketed to blue-collar workers and campers, Stanley built its reputation on durability, offering a product backed by a lifetime guarantee. The brand then supercharged its growth by appealing to a demographic it had largely overlooked in its first century: women.

Where it all began: the social media craze

Speaking of durability, the tumbler’s rise to fame began with a single viral moment in 2023.

A TikTok video showing a woman’s car completely destroyed in a fire, with only her Stanley tumbler left untouched, quickly captured the internet’s attention. Stanley’s president responded with a video offering to replace her car, a gesture that humanized the brand and amplified the story.

On TikTok alone, the clip garnered more than 7 million views.

@stanleybrand#stitch with @Danielle ♬ original sound - Stanley Brand

Long before this moment, however, the groundwork had already been laid by “The Buy Guide,” a group of lifestyle influencers who began promoting the Quencher back in 2019. Their endorsements introduced the tumbler to a largely female audience and helped spark the initial wave of interest.

Once the fire video reignited attention, the social media wave intensified.

TikTok, Instagram, and other platforms flooded with user-generated content: unboxing videos, color-collection hauls, morning and gym routines, and durability tests. Influencers and everyday users alike shared their Stanley stories, creating a network of authentic promotion no traditional ad campaign could replicate.

The Stanley effect: the power of marketing

Stanley did not miss the opportunity and turned it into a marketing masterclass that will be studied for years to come.

Instead of reinventing the product, the brand focused on expanding its appeal. Limited-edition colour drops, seasonal launches, and coordinated influencer partnerships drove demand and created urgency.

The Quencher became an accessory for the “clean girl” aesthetic. Each new release triggered waves of online content, and “fear of missing out” (FOMO) led to people lining up at stores and a robust resale market. Sellouts happened within minutes.

Stanley quickly joined the ranks of status-driven products, comparable to other popular products like Hydro Flask, Yeti, Owala, and Starbucks' seasonal cups, but its widespread online presence and collectible appeal stood out and outperformed these established premium companies.

Terence Reilly, who previously led the viral rise of Crocs, became Stanley's global president in 2020 and doubled down on this new direction.

“In 2022, we experienced record-breaking business growth and renewed brand awareness. With this success comes the opportunity to further invest in things we care about: delivering more sustainable products, building inclusion into everything we do, and supporting our employees and communities,” said Reilly in the official Stanley impact report 2023.

What do the numbers say?

Stanley’s parent company, Stanley Black & Decker, reported full-year net sales of $15.78 billion in 2023, with the Tools & Outdoor segment, which includes Stanley drinkware, accounting for $13.37 billion.

The fourth quarter of 2023 alone saw Tools & Outdoor net sales of $3.15 billion, with a segment margin of 9.3 %, up from 0.1 % in Q4 2022. Free cash flow for the year was $853 million, and inventory was reduced by $1.1 billion versus the end of 2022.

These figures show how the Quencher's viral popularity boosted Stanley's sales while also contributing to the parent company's overall growth and profitability.

Infiltrating the Pakistani market: The knock offs

In Pakistan, Stanley emerged as a niche yet visible trend, particularly among urban millennials and Gen Z consumers.

While Stanley does not yet have a large official retail presence, tumblers are available through specialty importers, online stores, and personal shoppers from the UAE and US via Instagram and Daraz. Prices for authentic 40 oz Quenchers range from Rs 4,000–20,000, depending on the seller and edition.

Limited stock and social-media-driven hype have created an active market which has fueled a knock off market. There is a thriving market for replicas and “inspired by” designs, most of which are locally imported from China. These tumblers closely mimic the original in shape, color, and branding, though they are generally made with lower-grade materials. Knock-offs sell for PKR 1,000–3,000, making the trend accessible to a wider audience while maintaining the visual appeal and aspirational value of the Quencher.

Stanley’s rise from a rugged, utilitarian brand to a global lifestyle icon is a case study in how storytelling, community-driven marketing, and cultural relevance can transform even the simplest product.

What began as an unassuming tumbler evolved into a symbol of identity, aspiration, and modern consumer behavior, fueled not by traditional advertising, but by authentic digital advocacy and strategic brand agility.

Even in markets like Pakistan, where official retail presence is limited, the Quencher’s appeal has seeped into daily life through imports, influencers, and an inevitable wave of knock-offs. In the end, Stanley’s success reveals a deeper truth about today’s consumers: they don’t just buy products. They buy stories, status, and a sense of belonging.

Latest News

South Africa thrash West Indies in T20 World Cup statement win

3 HOURS AGO

Nearly 8,000 died or vanished on migrant routes in 2025: UN

3 HOURS AGO

Russian says 'no deadlines' to end Ukraine war

4 HOURS AGO

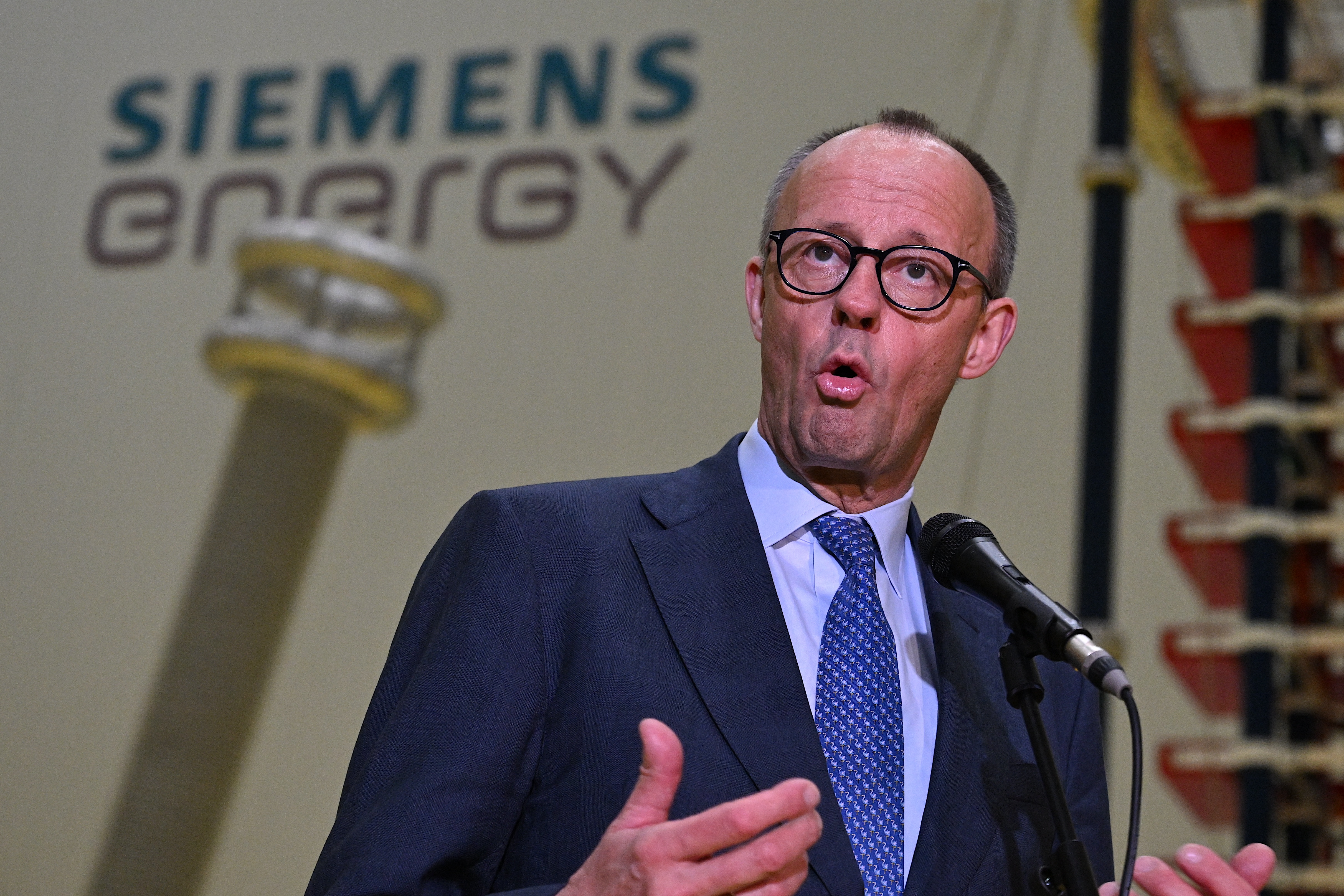

Merz says Germany, China must overcome trade gaps 'together'

6 HOURS AGO

Pakistani, European ministers agree on coordinated strategy to combat illegal migration

7 HOURS AGO