Pakistan’s central bank cuts policy rate by 50bps to 10.5% in surprise move

Headquarters of the State Bank of Pakistan in Karachi. (File, Radio Pakistan)

LAHORE: Pakistan’s central bank on Monday cut the benchmark policy rate by 50 basis points to 10.5%, marking a surprise shift after maintaining a status quo in the previous four monetary policy meetings.

Pakistan Prime Minister Shehbaz Sharif welcomed the State Bank’s decision, saying, “By the grace and favor of Allah, the hard work of the government's economic team is bearing fruit,” according to an official statement from his office.

The prime minister added, “Small and medium-sized businesses will benefit the most from the reduction in the interest rate and the availability of lower-cost loans.”

The decision by the State Bank of Pakistan (SBP) runs counter to market expectations. A Reuters poll of 12 analysts had projected no change, with most respondents expecting easing to be delayed to the later months of FY26 or beyond.

The forecasts were revised after the International Monetary Fund (IMF) cautioned that inflation risks remain elevated and monetary policy should stay appropriately tight.

This latest cut follows the SBP’s last easing of 100 basis points announced after the May 5 meeting, which brought the policy rate down to 11%. With Monday’s move, cumulative easing since rates peaked at 22% in April 2024 now stands at 1,150 basis points.

In its post-meeting statement, the Monetary Policy Committee (MPC) said that headline inflation, on average, remained within the target range of 5-7% during July-November FY26. However, it noted that core inflation has remained relatively sticky, while headline inflation benefited from benign global commodity prices and anchored inflation expectations under a prudent monetary policy stance.

Looking ahead, the MPC warned that inflation could rise above the target range toward the end of FY26 due to a low base effect from last year, before easing back into the target band in FY27.

The committee said economic activity continues to gain traction, citing a robust improvement in key high-frequency indicators, including a higher-than-anticipated increase in large-scale manufacturing during the first quarter of FY26. “In this backdrop, while ensuring ongoing price stability, the MPC noted the available space to reduce the policy rate to support sustainable economic growth,” the statement said.

At the same time, the MPC flagged persistent external challenges, particularly for exports, amid a fluid global environment marked by evolving tariff-related dynamics and tight financial conditions.

The central bank highlighted several key developments since its last meeting. According to the Labour Force Survey 2024–25, the unemployment rate has increased compared to 2020–21, despite faster employment growth.

Meanwhile, SBP’s foreign exchange reserves continued to rise despite sizeable debt repayments, crossing $15.8 billion after the IMF disbursed $1.2 billion following the successful completion of reviews under the Extended Fund Facility (EFF) and the Resilience and Sustainability Facility (RSF).

The MPC also noted an improvement in consumer confidence, as reflected in the latest SBP-IBA surveys, while business confidence remained positive but moderated slightly. On the fiscal front, sizable SBP profit transfers helped the overall and primary fiscal balances post surpluses in the first quarter of FY26.

Assessing the broader outlook, the committee said the real policy rate remains adequately positive to stabilise inflation within the 5-7% target range over the medium term, while also supporting sustainable economic growth.

The rate cut comes days after the release of the IMF’s staff report, which reiterated that Pakistan’s monetary policy should remain sufficiently tight and data-driven to keep inflation within the SBP’s target range. The IMF noted that the central bank’s cautious approach had helped manage inflation risks amid volatile conditions and temporary declines in headline inflation.

Latest News

South Africa thrash West Indies in T20 World Cup statement win

2 HOURS AGO

Nearly 8,000 died or vanished on migrant routes in 2025: UN

2 HOURS AGO

Russian says 'no deadlines' to end Ukraine war

3 HOURS AGO

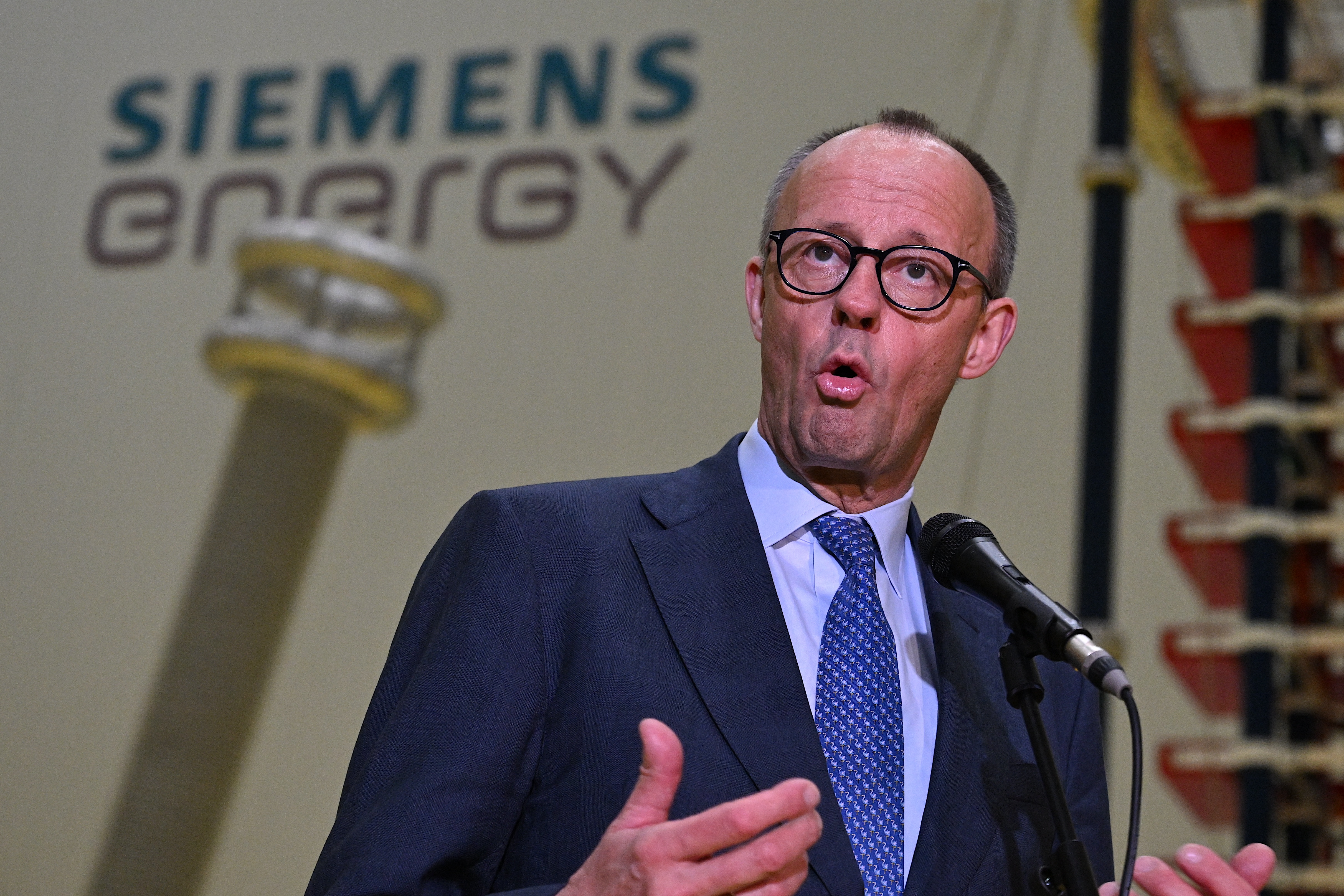

Merz says Germany, China must overcome trade gaps 'together'

5 HOURS AGO

Pakistani, European ministers agree on coordinated strategy to combat illegal migration

6 HOURS AGO