HONG KONG: Gold prices broke the $4,000 mark for the first time on Wednesday as investors flocked to the haven amid expectations for US interest rate cuts and concerns over the US government shutdown.

The rally in the precious metal also came after concerns that a tech-fueled rally, which has sent some equity markets to record highs, may have gone too far, fueling talk of an asset bubble.

Traders have been piling into gold all year, pushing its price up by more than 50 percent since the start of the year, driven by a range of issues, including global economic uncertainty, Donald Trump's trade war, and geopolitical crises.

Its allure was increased further this week by political turmoil in France, where the country's prime minister resigned and President Emmanuel Macron's former premier urged him to resign and call early elections.

Gold — long considered a go-to in times of uncertainty — climbed to a high of $4,006.68 on Wednesday, even as the dollar has pushed up against most of its peers in recent days. Silver was also within a few dollars of its own record high.

The closure of parts of the US government is adding to the sense of unease among investors, with key economic data, including on jobs, being postponed and muddying the waters for the Federal Reserve as it tries to decide on its rate plans.

"The rapid rise in gold prices has been supported by rising inflows into (exchange-traded funds) and central bank buying, including solid demand from China, as gold benefits from political, economic, and inflation uncertainty," wrote Taylor Nugent at National Australia Bank.

While gold traders were busy pushing the metal ever higher, equity markets in Asia were more subdued as questions arose about the hundreds of billions of dollars invested in artificial intelligence.

The AI boom has seen some indexes and companies hit record highs, with chip titan Nvidia topping a $4 trillion valuation.

However, a report that Oracle's cloud computing profit margin was significantly lower than expected sent shivers through trading floors, with all three main indexes on Wall Street falling into the red.

"In a market priced for perfection, any delay in cash flow — even a temporary one — feels like the bartender calling 'last call'," wrote Stephen Innes of SPI Asset Management.

"Traders didn't wait for clarification; they simply started easing out of their positions. The Oracle story didn't crash the party, but it definitely sobered it."

Tech firms, which have enjoyed strong buying this year and in recent months, led selling in Asia.

Hong Kong and Taipei were among the biggest losers, while Sydney and Singapore also fell.

Tokyo was marginally higher, helped by lingering optimism that the election of business-friendly conservative Sanae Takaichi as the ruling party's leader will see more stimulus measures and a fresh push for monetary easing.

Wellington, Manila, and Jakarta also edged up.

Key figures at around 0230 GMT

Tokyo - Nikkei 225: FLAT at 47,965.29 (break)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 26,764.89

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1636 from $1.1652 on Tuesday

Pound/dollar: DOWN at $1.3407 from $1.3422

Dollar/yen: UP at 152.39 yen from 151.97 yen

Euro/pound: DOWN at 86.79 pence from 86.83 pence

West Texas Intermediate: UP 0.7 percent at $62.18 per barrel

Brent North Sea Crude: UP 0.6 percent at $65.87 per barrel

New York - Dow: DOWN 0.2 percent at 46,602.98 (close)

London - FTSE 100: UP 0.1 percent at 9,483.58 (close)

Latest News

South Africa thrash West Indies in T20 World Cup statement win

2 HOURS AGO

Nearly 8,000 died or vanished on migrant routes in 2025: UN

2 HOURS AGO

Russian says 'no deadlines' to end Ukraine war

3 HOURS AGO

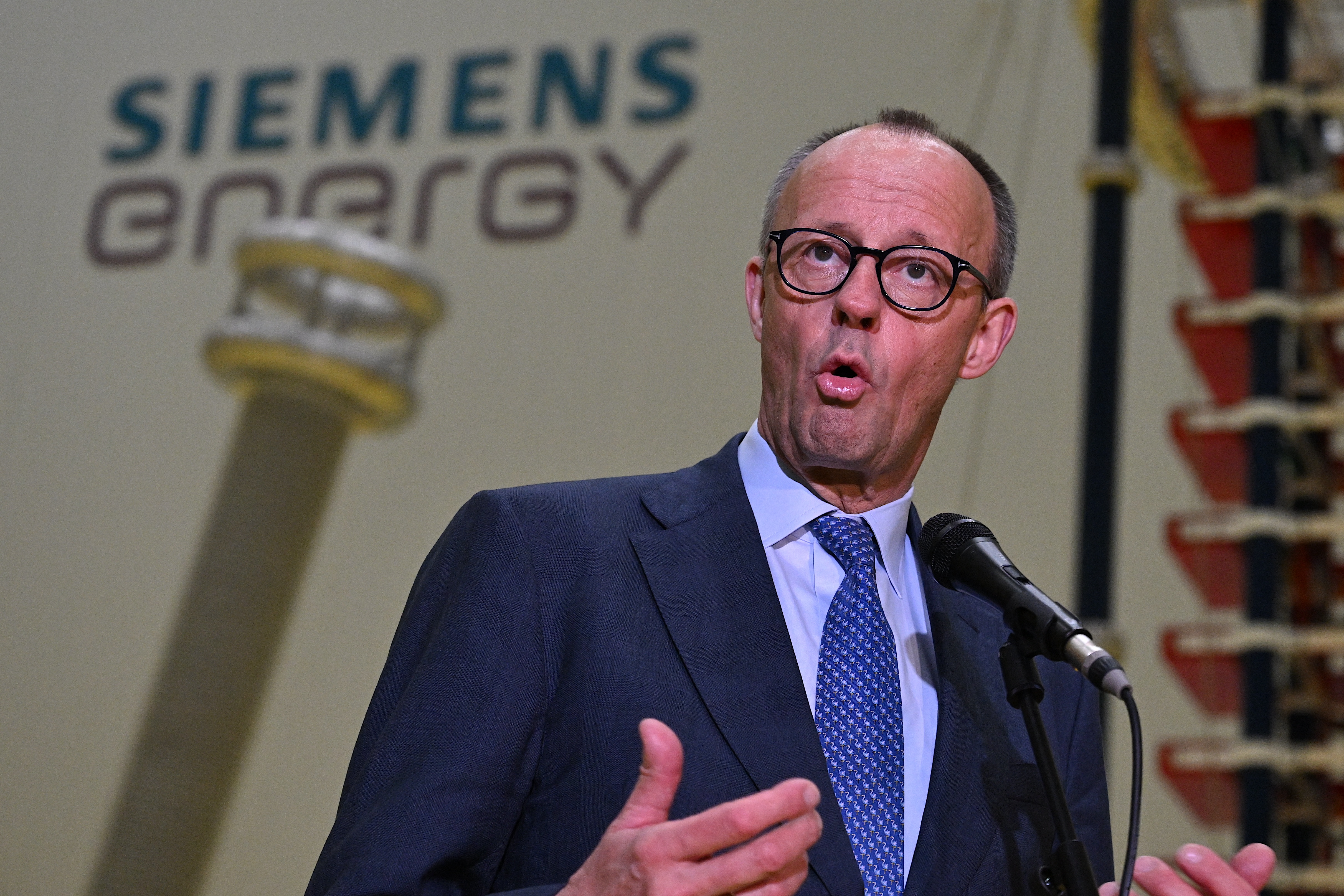

Merz says Germany, China must overcome trade gaps 'together'

6 HOURS AGO

Pakistani, European ministers agree on coordinated strategy to combat illegal migration

6 HOURS AGO